an old chap of mine discussed this with me and this is the framework I'm choosing to entertain given the context and discussion about 4 year cycles.

We also have a number of things coming up that are bullish for markets like more rate cuts and QT ending but usually it's not that straightforward and the transitory period is choppy and gay. That being said, I think we will be higher in a few months.

PA will maybe the same as it's been the past year; more chop with the occasional spike up to new ATHs with 1-3 things running onchain.

I actually also think there's a lot of money onchain still but none of it is interested in buying anything atm, which is why the loops are smaller

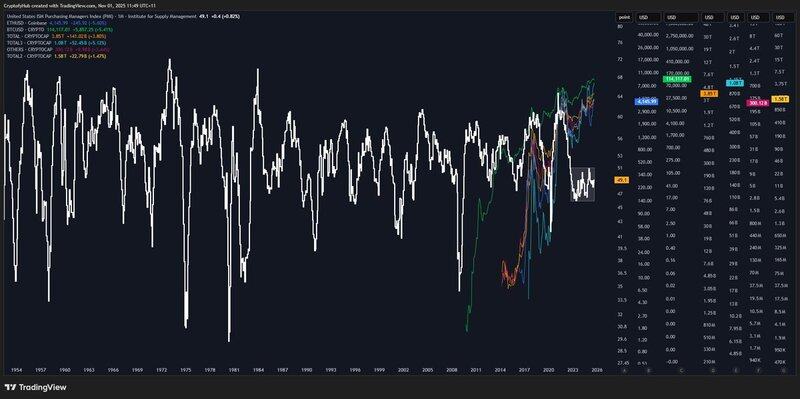

While many think there’s something wrong with crypto or altcoins because it’s not following the “four year cycle”, the truth is there’s never been a real four year cycle.

It’s always been a coincidence that people link to Bitcoin’s halving.

Every crypto bull and bear market actually follows economic cycles, not supply or halving events.

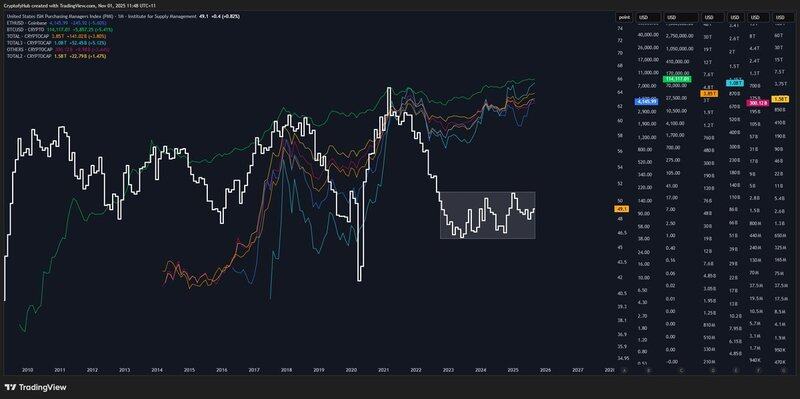

If you look at the ISM PMI, which measures business expansion and contraction, you’ll see that every major crypto expansion happened when the PMI was rising, when liquidity was flowing and the environment was risk-on.

Right now the PMI has been stuck at range lows for the longest time on record. That means the economy has been neutral or contracting, and risk assets like crypto have been held underwater. But make no mistake, it will soon expand again.

Think of the crypto market as a balloon under water. The moment PMI expands again, liquidity returns and that balloon shoots up.

After this long of a range, the breakout could be explosive, leading to a blow off top.

Forget the halving. Watch the cycle.

5.56 K

3

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.