an old chap of mine discussed this with me and this is the framework I'm choosing to entertain given the context and discussion about 4 year cycles.

We also have a number of things coming up that are bullish for markets like more rate cuts and QT ending but usually it's not that straightforward and the transitory period is choppy and gay. That being said, I think we will be higher in a few months.

PA will maybe the same as it's been the past year; more chop with the occasional spike up to new ATHs with 1-3 things running onchain.

I actually also think there's a lot of money onchain still but none of it is interested in buying anything atm, which is why the loops are smaller

While many think there’s something wrong with crypto or altcoins because it’s not following the “four year cycle”, the truth is there’s never been a real four year cycle.

It’s always been a coincidence that people link to Bitcoin’s halving.

Every crypto bull and bear market actually follows economic cycles, not supply or halving events.

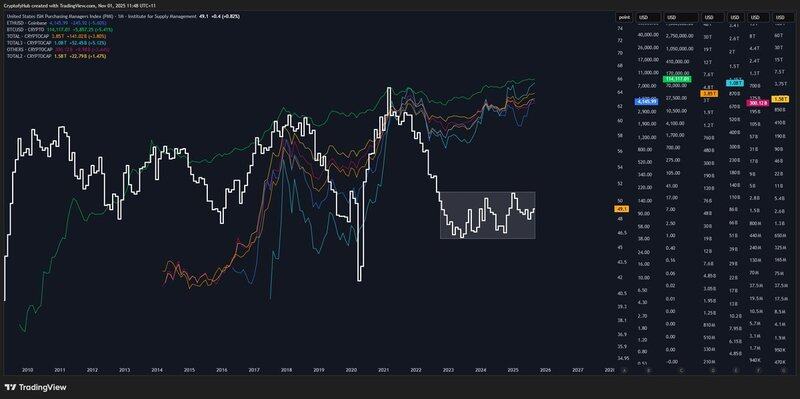

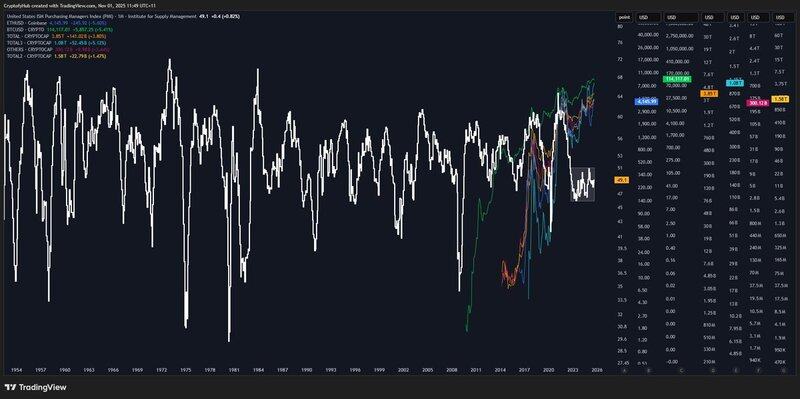

If you look at the ISM PMI, which measures business expansion and contraction, you’ll see that every major crypto expansion happened when the PMI was rising, when liquidity was flowing and the environment was risk-on.

Right now the PMI has been stuck at range lows for the longest time on record. That means the economy has been neutral or contracting, and risk assets like crypto have been held underwater. But make no mistake, it will soon expand again.

Think of the crypto market as a balloon under water. The moment PMI expands again, liquidity returns and that balloon shoots up.

After this long of a range, the breakout could be explosive, leading to a blow off top.

Forget the halving. Watch the cycle.

5.57K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.